Article 17: Paragraph 1 and paragraph 4 of article 84 of Ordinance-law n ° 69/009 of February 10, 1969 relating to schedule taxes on income are amended as follows:

Read MoreNEWS

Tax News in congo....Actualités Impôts en rdc

After 5 years of a collaborative approach to discussing the issues of wealth gaps, TaxCOOP is broadening its horizons by organizing the World Tax Summit - TaxCOOP2020, from October 13 to 15, 2020.

Read MoreThe OECD will present on Monday, October 12, 2020 at 11:00 a.m. (Paris time, 9:00 a.m. GMT) an update on the progress of the negotiations led by the 137 members of the Inclusive Framework on BEPS to reach a multilateral and consensual solution to the challenges taxes linked to the digitization of the economy.

Read MoreThe official journal of the Democratic Republic of Congo published on September 15, 2020, a decree relating to the method of payment of debts to the State.

Read MoreYou will find in this table, the different depreciation rates for buildings, vehicles, etc ...

Read MoreGOVERNMENT Prime Minister's Office June 13, 2013 - Decree No. 13/020 conferring the status of town and municipality to certain agglomerations of the Province of Katanga,

Read MoreThe taxation of land in the Democratic Republic of Congo - Case of the city of Kinshasa.

Read MoreNon-profit organizations are taxed on the basis of Law n ° 004/2001 of July 20, 2001 laying down general provisions applicable to non-profit associations and public utility establishments.

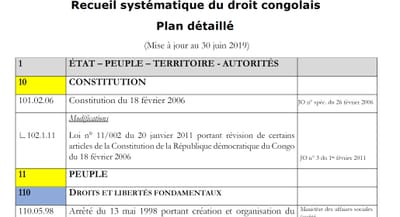

Read MoreThe collection of texts in the DRC on June 30, 2019. A guide to find laws, orders, decrees, etc ....

Read MoreThis is a generic blog post that you can use to add content / topics to your website.

Read MorePersonal property tax is a tax which is levied on: - income from shares or shares; - income from bonds;

Read More